In 2013, PricewaterhouseCoppers (PwC) published its 16th annual global CEO survey. It’s a hefty survey with responses from 1,300+ CEOs across 68 countries. To me, this type of survey is very credible. CEOs suffer from the herd mentality like any of us do, but they do have a pulse on the market and can make hiring / capital investment decisions.

PwC did a good job with this report

In the boring old days, they would have put together a 100+ page report and be done with it. Not this time. They put together several ways to dig into the data whether by written reports, online tools, or CEO videos.

1. Written reports

These are a bit high-level, but they are good for hallway conversations. At the very least, you have something intelligent to say when you go to lunch and the client starts talking about the World Economic Forum.US Survey results (22pg pdf)

After skimming through this, you will see that CEOs are cautious. Almost bearish. This is how the 1,300+ CEOs responded to this question: “Do you believe the global economy will improve, stay the same or decline in 2013?” . .

- 18% Improve

- 52% Stay the same

- 30% Decline

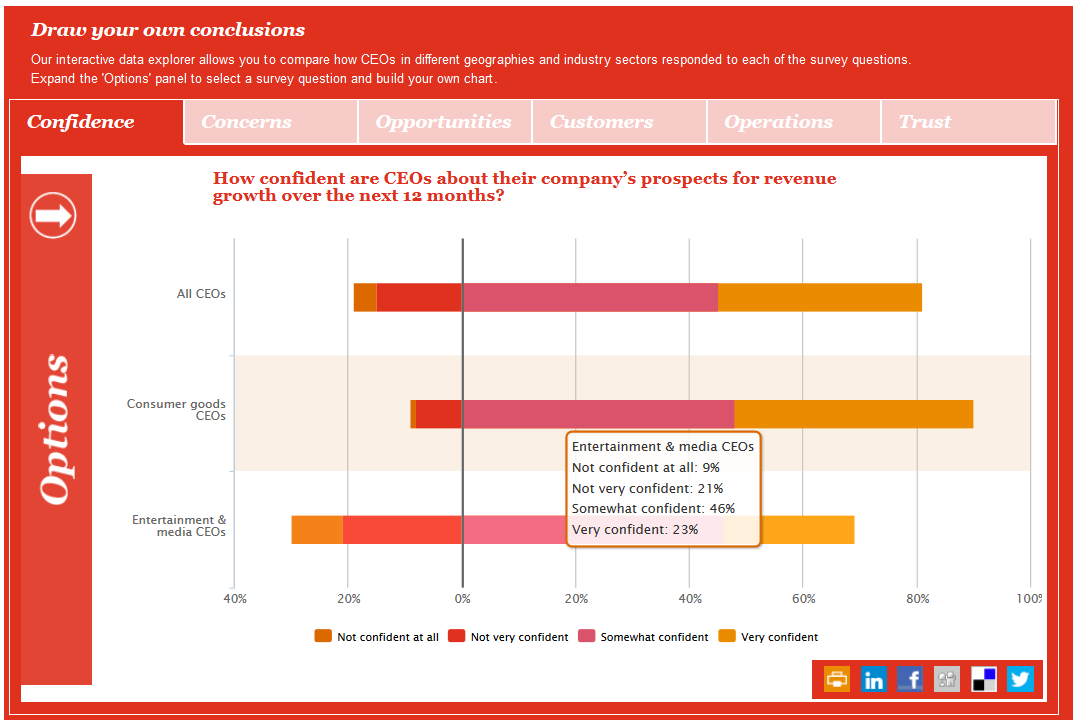

2. Interactive tool

Consultants know that averages don’t mean much. The high and low scores cancel each other out, and you end up with generalizations. Thankfully, PwC created an interactive way to play with the data (note: since discontinued). For example, this chart compares the responses of three different groups to the same question: How confident are you about your company’s prospect for revenue growth over the next 12 months? Here, consumer goods CEOs are the most bullish.

3. CEO interviews:

They have 30+ CEO interview clips (since discontinued) from the CEOs from Blackrock, Schneider Electric, Nokia, Commerzbank etc. In particular, they talked a lot about managing risk by creating more nimble and flexible organizations.

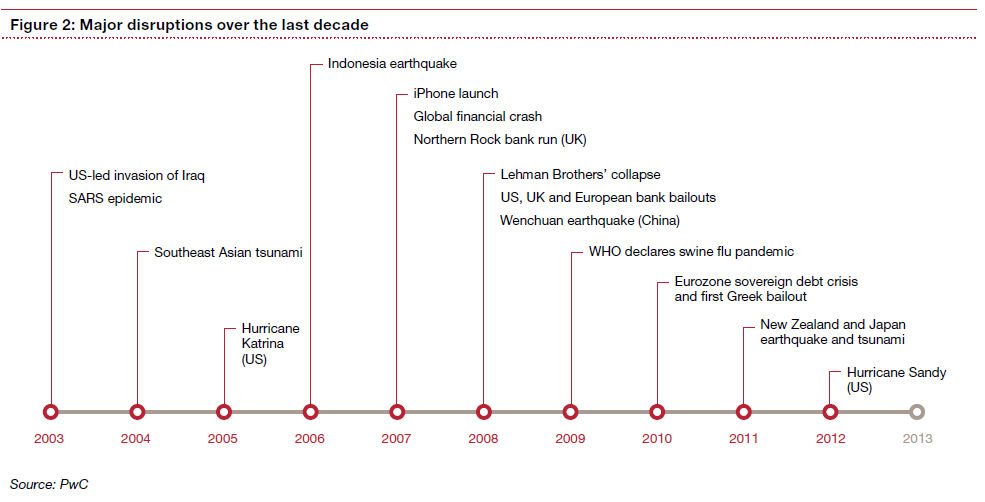

There is a lot of risk out there

Just looking at the list of man-made and natural disasters below, there is a good reason that PwC called the last 10 years the “Disruptive Decade.” The lesson seems to be that traditional “risk management” may be insufficient.

- Blind spots on the types and scope of risk (e.g., black swan events)

- Velocity and interconnectedness of the markets (e.g., Lehman Brothers)

- Large number of markets (e.g., a crisis somewhere that is affecting business)

4. Industry-specific highlights:

PwC also put the highlights for each of the 19 different industry segments. For consultants about to roll-on a project in a new industry, this gives a good sense of the mega-trends and the industry mood.

Takeaway #1: Surveys create data

Wrote a longer post on this here, but let’s agree that surveys are an excellent way to create data. It taps into the wisdom of the crowds and if you get the demographic information (who replied to what), you can do some fancy segmentation. It also puts together numbers to support your hypotheses.

Takeaway #2: This is marketing

Thought-leadership is a great way to market professional services. That is why there are so many conferences, trade shows, and white papers. Of course, PwCers want to interview CEOs. Who doesn’t? Notice there is not a PwC global analyst survey.

On the industry pages, you can easily see the contact information for each of the industry leads. On the automotive page, can see that Rick, Thomas, and Felix run the PwC automotive practice. Give them a call.

Takeaway #3: Industry matters.

Management consultants – especially early in their career – are unique in that they are less specialized by industry. It is a gift because you get to work on diverse projects, and you can see the connections across businesses, functions and industries. You are focused on how businesses run, not industry. This does not last forever. Clients are more demanding and don’t want you learning the industry on their dime.

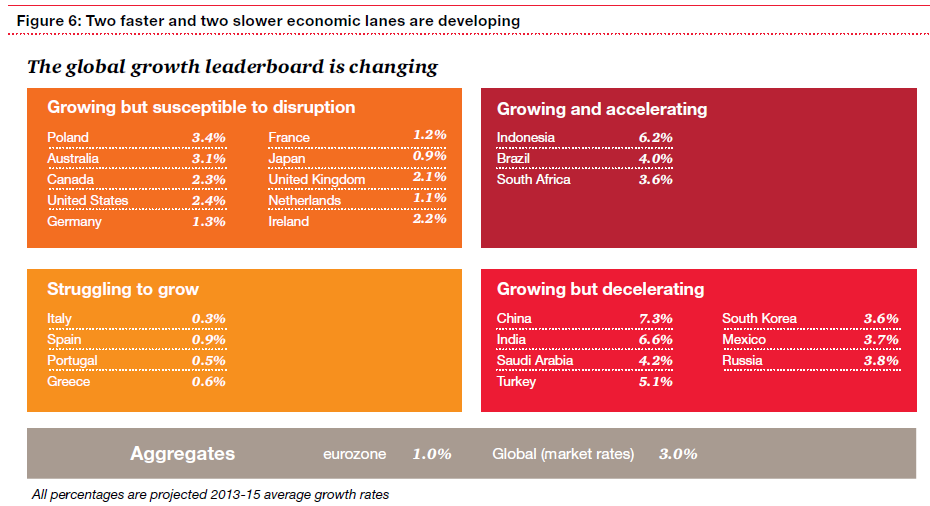

Takeaway #4: They used other sources too.

Frankly, CEO surveys are usually very high-level, and therefore, less valuable. It’s an art to really think on the topic and divine meaning out of the results. In the PwC reports you will find a fair amount of analysis that they brought from outside the survey. It is a cocktail of data from disparate sources. For example, this table shows the current growth and acceleration/deceleration of that growth. Trust me, this did not come from a survey of CEOs.