Not sure how this happens, but the entire developed world is in debt. Europe, the US, and Japan have borrowed so much money that they are headed towards ruin. The Boston Consulting Group even went so far as to call it the biggest Ponzi finance scheme in history. That is some pretty bold talk from a buttoned-downed group of consultants.

After reading the BCG report Collateral Damage: Ending the Era of Ponzi Finance, I tend to agree with them. The 23 page report is well-argued and makes 3 points: 1) the global debt picture is pretty bad . . . 2) and getting worse . . . 3) unless something is done soon.

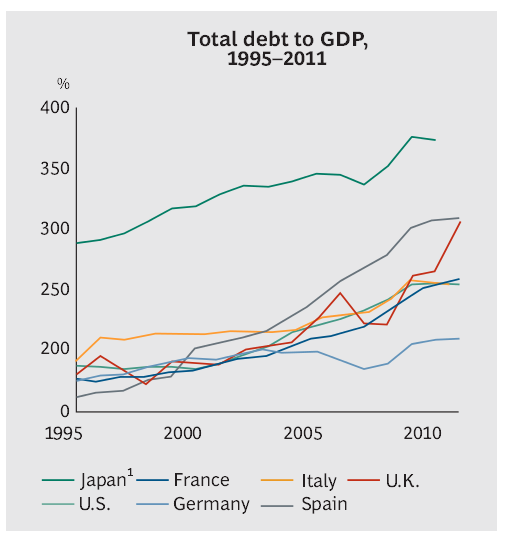

Developed economies are in enormous debt

Europe, the US, and Japan have taken on monstrous levels of debt and are not really getting a good return on that money. It would be different if the money was being invested productively, but too much of it is just being spent. Governments, companies, individuals – all need to take some blame.

It is not simply that the developed world has borrowed significantly from future wealth to fund today’s consumption, leading to huge burdens for the next generation. It has also reduced the potential for future economic growth, making it more difficult for the next generation to deal with this legacy. -BCG

In the BCG graph below, you can see that the total debt (government, corporate, and household) is many multiples of the countries’ GDP. Put another way, Japan’s debt is 3-4x the total output of the country. Can you image if your personal debt was 4x what your gross income was? Any good financial planner would be screaming at you to reduce your debt and increase your income.

The debt situation is getting worse

This is a bummer to say, but there are many reasons why the debt burden could increase over the next 20 years.

- Under-funded pensions: Governments and companies have made promises to their citizens and retirees that have not adequately funded. Pew reported that the largest 61 US cities have only funded 74% of their pension liabilities.

- Longer lifespan and healthcare costs: People are living longer which is good news, but how will this all be paid for? Healthcare costs are rising faster than inflation. In the same Pew report, the top 61 US cities have only funded 6% of their retirees’ health care liabilities. This is a huge problem that is getting worse.

- Fewer young people: Often times, pension costs are paid for by the contributions of younger workers who are essentially paying it forward. Well, what happens when you have fewer younger people than older people? BCG put together this fascinating chart that shows that the population has already peaked in many Europe countries. Even China (not one of the “developed countries” with a debt problem) has an issue with their population peaking much earlier than India because of the one-child policy.

- Rising interest rates: Although not explicitly mentioned in the BCG report, rising interest rates pose a huge risk. Like any good monetarist, I believe the increase in money supply and competition for resources will drive up rates longer-term. Have developed countries become too complacent? How much longer will investors buy US government 30 year bonds at 3.125% (2/14/13).

- Many other reasons including lower productivity, under-investment in the asset base, rising prices for resources, international competition, barriers to innovation

What’s to be done? BCG argues that there are steps that can be taken to reduce the risk of this global financial car-wreck. Find the full list (since removed from BCG site), starting on page 14.

They are not simple solutions. Systemic issues require a strong dose of political will and leadership. It will take more than just marginal improvement. Financial sacrifices will be required from all interest groups. Perhaps the most direct statement in the BCG report:

The critical starting point is to accept the fact that many of today’s debts will never be repaid and to embrace debt restructuring and defaults. – BCG

BOOM – If that is not a strong statement, that yes indeed, the debt burden of developed economies is a Ponzi scheme that does need some unraveling.