GDP = C+I+G+NX

Sadly, that is the only formula I remember from my undergraduate macroeconomics class, but thankfully, it is the most important one. The Gross Domestic Product = Consumption + Investment + Government + Net Exports (Export-Imports). It’s worth remembering, even if you don’t work at the World Bank or teach economics.

USA = C

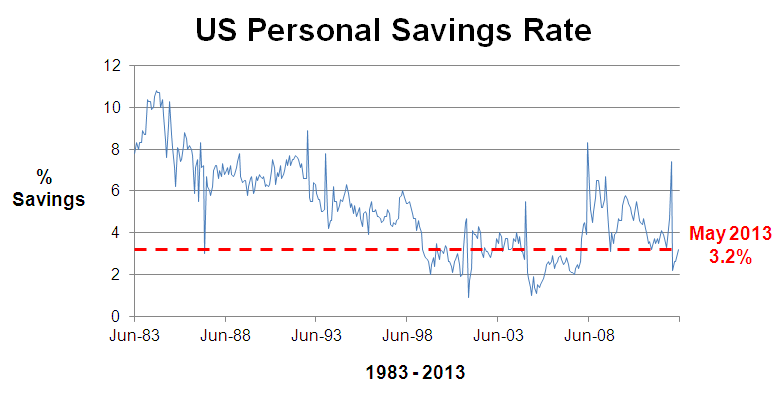

Americans are incredible spenders. Until recently, we had a miserably low personal savings rate of about 3%. We spend a lot and save very little. I put together this graph which shows a pretty steady drop in the savings over the last 30 years. The data shows a dramatic pop in savings rate starting in 2008, which must be people’s reaction to the recent financial melt-down. Time to batten down the hatches.

Americans live large

Americans consumer 32x more stuff (food, power, water, transportation etc) than people in the developing world. Without being too development economics about it, people in the development world (read: US, Europe, Japan) could probably consume less, and find ways to help the extremely poor live better in a sustainable way. The world cannot support everyone with American-sized consumption. Jared Diamond (of the Guns, Germs, and Steel fame) makes the compelling case here.

China = I

I was surprised to learn that China’s economy is primarily built on investment. All the factories, dams, roads, airports, and construction make up 50% of the economy. Surely, that capacity supported the manufacturing and exports-led growth of the last 30 years. For all issues that China has, it has done an enormous job of bringing people out of poverty. The Economist notes that “China pulled 680m people out of misery in 1981-2013, and reduced its extreme-poverty rate from 84% in 1980 to 10% now.” Big numbers.

It’s remarkable economic progress, but when do those infrastructure projects start (have already started?) to waste money. Will China become like Japan (and the state of Alaska), with bridges and roads stretching out into nowhere? In the graph below, you can see the grey bars of investment growing a lot faster than either investment or net exports.

Paul Krugman wrote an op-ed piece recently in the NY Times entitled: Hitting China’s Wall, where he argues that China’s 3 decades of growth looks like it is coming to an end. Lot of reasons, but he says that China cannot simply grow by investing more. Krugman mentions W Arthur Lewis’ economic theory on developing economies having lots of surplus labor, which keeps wages down and encourages investment-fueled growth. In a not-so-poetic way, Krugman points out:

It’s all very peculiar by our standards, but it worked for several decades. Now, however, China has hit the “Lewis point” — to put it crudely, it’s running out of surplus peasants.

Everyone = G

Governments across the world are broke. They have lots of pension obligations and generally have spent more than they make. This graph shows government spending as a % GDP. In this small sample, you can see that the UK, Brazil, and Germany are higher than the US. Oddly, China’s spending is less. Why?

Of course, the World Bank data quality is only as good as what the governments report. Clearly China’s government drives a large portion of the “investment” by it’s state-owned enterprises which is not shown in the 13% number above. Also, it is not an apples-to-apples comparison. The UK has universal healthcare coverage for its citizens. If you added in healthcare, the US number would be much higher.

GDP is a an imprecise science

Many of the economics offices of smaller countries do not have the resources, or ambition to measure the size of the economy the way the US might. Also, governments have perverse incentives to make their economies look bigger, and smaller depending on the political and economic climate. (hey you – yes, you China). This Planet Money story tells how an African country’s GDP doubled in 1 day because they improved the method to calculate the size of the economy, and how that influenced the way it applies / gets foreign aid.

Lopsided economies

I realize that it is a connected global economy, but why are the GDP profiles of countries so lopsided? Seems like Americans need to invest more and spend less. Conversely, the Chinese are smart to slow down their investment or else they will have a lot of infrastructure left-over – empty airports and bridges to nowhere.