Most management consulting firms are privately held. They start off as partnerships and remain that way: McKinsey, Bain, BCG, Deloitte, E&Y, KPMG, PWC, AT Kearney, PA Consulting, and LEK etc. PRTM, Monitor and others were bought out. It takes a lot of patience, trust, and brand-building to build a management consulting firm – and that is probably why so few of them go public. Wall Street looks for quarterly returns, which does not always help the building of a professional services firm.

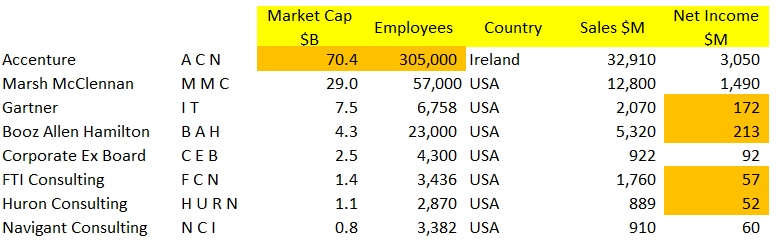

Publicly-traded consulting firms. Using Finviz here, I down-selected a few firms that we would consider management consulting or related. Note that I did not add in IBM, CSC, Wipro, Tata, HP or other companies which have a large IT consulting division:

- Accenture investor relations pdf (285K download)

- Marsh & McLennan quarterly earnings pdf (700K download) (HT: Marina)

- Gartner investor relations pdf (8Mb download, watch out)

- Booz Allen Hamilton annual report pdf (3Mb download)

- Corporate Executive Board investor relations pdf (4Mb download)

- FTI Consulting investor relations pdf (793k download)

- Huron Consulting investor relations pdf (6Mb download, watch out)

- Navigant Consulting investor relations pdf (1.2Mb download)

- Market Cap. Clearly ACN is the beast here. $70 billion . . . vs. everyone else

- Employees. ACN has 300K employees, everyone else has significantly less people, and also

- Incorporation. All located in the US, with the exception of ACN – who is incorporate in Ireland. Clearly a case of finding the most attractive tax regime.

- Sales and net income. These need to be looked at together. FTI Consulting 2x the sales of Huron, but the same net income.

- Dividend. Only a few firms give out dividends, indicating a bit more stability, and typically slower growth. Management somehow sees giving $$ back to shareholders as a better return than investing it in the business.

- Net margin. (Un)surprisingly, management consulting has a low net margin. After paying the expensive resources (read: consultants), there is not a lot left for shareholders. It is a high-cost business. Utilization and retention matters. The only firm that seems to be converting revenue into profits at any scale is ACN and MMC, the largest of the bunch. Question: Does this argue for economies of scale with larger firms? Initial indications say “Yes”.

- Quick Ratio. This is a metric which tells you how easily a company can pay its short-term obligations. Formula = (current assets – inventory) / current liabilities. In non-CFO talk, if your quick ratio = 2, that means you have $2 in liquid assets to pay your short-term debts. The higher the number = more easily pay short-term debts. Here, Gartner and Corporate Executive Board have the lowest ratio, but also have an arguably less-capital intensive business – more research.

- Return on Equity. This is disorienting because some are too high (which you would think is a good thing. . ) except this means that BAH and CEB just don’t have enough equity in the business. Completely funded by debt. Some are too low: FTI and Huron are giving their investors a 8.5% or 10% return, not even factoring in potential downside risk. Not a good deal.

- P/E. Price / Earnings multiples are in the mid 20s. Not cheap. Gartner looks expensive at 46x. In other words, it would take 46 years of earnings to get the stock price back, assuming no growth in earnings.

- Stock performance. Not sure why, but both FTI and Huron are on their heels

Stock price. Looks like the stock market was unkind to FTI and also HURN last week.

Related posts: