Dave Ramsey

This is a famous radio host from the United States who I listen to regularly. He only talks about financial planning and money management – but he can be just a polarizing and crazy as the other “shock-jock” radio personalities. He has been doing 2-3 hour radio shows since 1992, so it is almost 20,000 hours of evangelism on smart money matters. He is making an impact on people in the US, it is worth your time.

Author of shocking, but fun book: Total Money Makeover here (affiliate link).

Like a smart uncle

If you are okay with listening to a straight-talking, Southern, not politically correct, but visionary financial coach, listen or watch Dave Ramsey’s podcast here. He has written several books, but I recommend his podcasts.

They are entertaining, informative, and a bit shocking. He is unafraid to describe your spending habits as crazy, your relationships as broken, or your investment strategies as stupid. It is not insulting, it’s just straight talk. He is loving and confrontational – like a smart uncle might be.

1) Common sense

He is the first to admit that his financial advice is basic. Afterall, the secret to money is to work hard, save, invest, and give. Simple. As one of his slogans say, “it’s the same advice your grandmother gives, but we keep our teeth in.”

- Work hard – Put in the extra work; 2nd and 3rd jobs are good.

- Earn more money – Ramsey tells people all the time that they have a “revenue problem”, not an expense problem

- Save – Pay yourself first. He calls this “acting your wage”

- Invest – Put your money to work; Same argument I made here that getting retired has more to do with the balance sheet (assets) than the income statement.

- Give – Ramsey argues that giving is a critical part of money management – to be thankful for your blessings; ultimately, money is a tool, not a goal.

2) Anti-debt

He is a vocal opponent to credit cards and any debt (besides a mortgage). He calls credit card companies evil and tells people to “cut up their credit cards.” He says that everyone should use debit cards or cash. He feels the same way with student loans. Everything should be in cash (with the small exception of a house mortgage); he calls car leases, car fleeces – because you are getting cheated out of money.

3) Anti-whole life insurance

This may be very US-centric, so for those not familiar with life insurance products, Ramsey likes #1 (basic, cheaper term-life insurance)

- Term life insurance – fixed term (e.g., 20 years) with a face value (e.g., $1million) which is paid out if you die within those 20 years. If you die in year 21, you get nothing. It is only insurance and is a cheaper alternative.

- Cash-value or whole-life or variable annuities – these are financial products which have other diverse features – growth or guaranteed return – which mix insurance with investments. Ramsey really does not like these.

Ramsey advocates for term-life only because it is cheap and does it’s job – covers you against unexpected death during your earning years. He argues that by the time the “term” is over – you should be financially independent if you have done your job right. He argues that “Cash value life insurance is one of the worst financial products available.” here. Understandably, this is pretty controversial point since there are 400K insurance sales people in the US.

4) Live like no one else, so later, you can live like no one else

Dave is really big into sacrificing now for the future. He tells people to get 2nd and 3rd jobs. He is proud of people who are willing to save 50-60% of their income to get out of debt. He praises people who live on “beans and rice” to get by. If you are in debt – you should be willing to drive a car you are actually embarrassed to drive. There is no shame in making sacrifices to get out of debt.

5) Accountability – Grow Up

Ramsey rightly believes that we – as basic humans – act stupidly with money all the time. He calls this the “stupid tax” and tells the story of how he did lots of stupid money things earlier in his life. In many ways, he is a libertarian.

Budgeting. He is a big believer in planning with a budget so that every dollar has a job. Also, he advocates using CASH to really get a corporeal feel for the money leaving your hand. It is an envelope system where you put all the money you are going to spend into envelopes and stick to that budget.

Communicating with your spouse. Too often marital problems start with money issues – which starts with miscommunication. He is straightforward – and expects spouses to talk frankly about their money and get on the same page. Often you can hear him say things like:

- Dude, your wife wants you to be a man, not a little boy when it comes to money.

- You need to grow up and really talk to your husband about this

- You need to go to marriage counseling; it’s more than a money problem

- You need boundaries in your life; I recommend you read Boundaries by Dr. Cloud

6) Debt free scream

This is one of his signature segments. People drive to his offices in Nashville, TN or call in, and tell their story. Dave asks them some routine questions:

- What made them decide to be debt free?

- What sacrifices did they make? Did people think they were crazy?

- What was the last debt that was paid off?

- How do they feel now they are debt free?

- How much did they pay off? How long did it take? Making what kind of money?

It is very raw and personal questions – but that is the point. You need to really OWN your situation. People who get MAD about their debt are the people who get things done. People who are willing to sell their cars, deliver pizza as a 2nd job, tell their children “no” to unnecessary expenses, are the ones who win. He says, “you have to live like no one else (poorly) to later live like no one else (debt free).

7) Straight talk

Honestly, he is a joy to listen to. He combines humor and humility, with real principles. He is an evangelical Christian – so he will quote the bible – but the core concepts of stewardship, family, and community transcend any specific religion. You won’t agree with everything he says -but he is self-aware – and does not expect you to. Make your own decisions. Get smart and think for yourself.

8) Americans need to save more

8) Americans need to save more

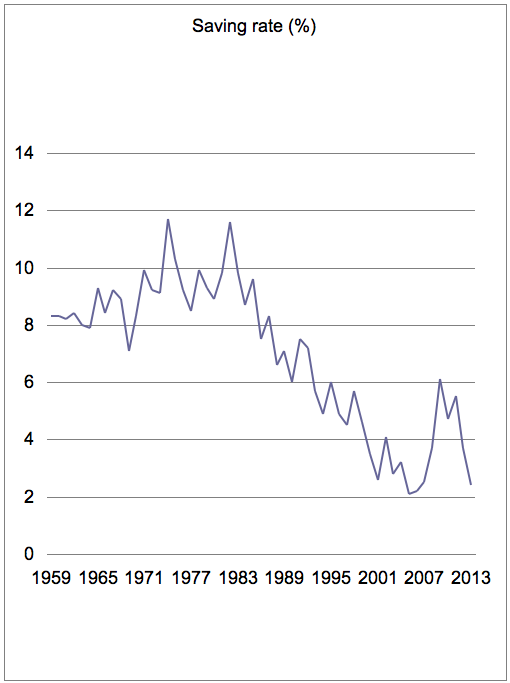

Fundamentally, Dave Ramsey’s disdain for debt makes sense. Look at the graphic to the right from the Economist in 2013, which shows the drop in American savings rate from poor (10-12% savings) to sloppy (2-5%) in recent years.

Americans are stupidly in debt. For people who only save 0-5% of their income, obviously any credit card charging you 15-22% annual is a death sentence. For good reason, Ramsey recommends 3-6 months of income in an emergency fund.

9) Financial Peace University (FPU)

This is a course where you attend a series of 9 classes – most often taken at churches and community centers – watch videos of Dave Ramsey’s coaching and go through a financial planning workbook. While I have not been, I know it is about $100-$150 (cheap), and a lot of the power is in the group accountability you have with the other attendees. It clearly works as he has people calling into the radio show daily who attest to benefits. In fact, “the average family pays of $5,300 in debt and saves $2,700 in the first 90 days [of FPU].”

10) Huge brand.

Dave Ramsey has a lot more than just radio show and books. He has expanded his brand to endorsing local providers (ELP) who “have the heart of teachers” and abide by Ramsey’s concepts of conservative financial planning. Ramsey has extended his influence and voice to entrepreneurship, leadership, and estate planning. Even his company has taken an inter-generational scope – his kids are involved in the business. They continue to grow and hire more people here.

Note: I am a huge fan of Dave Ramsey – for his principles, honest straight-talk, communication effectiveness, his ministry, and his humor. That said, I do believe that people who are mature enough to use debt (leverage) wisely, should do so. Basically, pay off my credit cards monthly, never carry a balance. Get rental properties where you put down 25%, borrow 75% from the bank at less than 4%. Rent properties with a ROE of more than 15%. Leverage is critical for smart people to get ahead.

For Dave Ramsey fans, I know this is antithetical to what Dave stands for. I know this sounds like I am being a hypocrite. Listen to 10-20 Dave Ramsey podcasts and make up your own mind. Most Americans are irresponsible with their finances and cannot handle debt. That said, wealth accumulation comes from massive savings, investing. Leverage helps as long as it is not speculation.

Huge fan & follower of Dave’s methods. I’ve been practicing them for well over a decade. Definitely a recipe for success financially.

Awesome. You’re a winner. What do you think of leverage? Rental homes and other investments with debt. Yes, under some circumstances or no way?

No, I don’t believe in borrowing to invest. Dave’s simple method provides an acceptable ROI and “financial” peace of mind. Applying the snowball effect to investing is when it gets really fun. All of this resulting in being able to give more and more. Which has that paradoxical effect of more and more opportunities coming your way.

Thank you. Financial peace.

Very sensible guy, here in Europe we’re always schocked how Americans are eager to go heavily into debt, but I guess it’s just a part of your willingness to take risks in life in general.

But being in my 30s I see how one can use debt to its advantage and create opportunities that would be not possible otherwise. Probably it’s just a matter of proper balance, like everything else in life.

Yes, believe that Europeans have been more fiscally conservative – as individuals – since Europeans have a deeper sense of history and corporate memory of difficult times and wars.

Believe that the United States also has a liberal bankruptcy law, so that it encourages innovation and failure – sometimes good, sometimes bad.

Finally, it’s all about risk-adjusted return. Question is what are you investing in (return and risk). Dave Ramsey argues that too many people underweight risk. Agreed. Thanks for the comment.