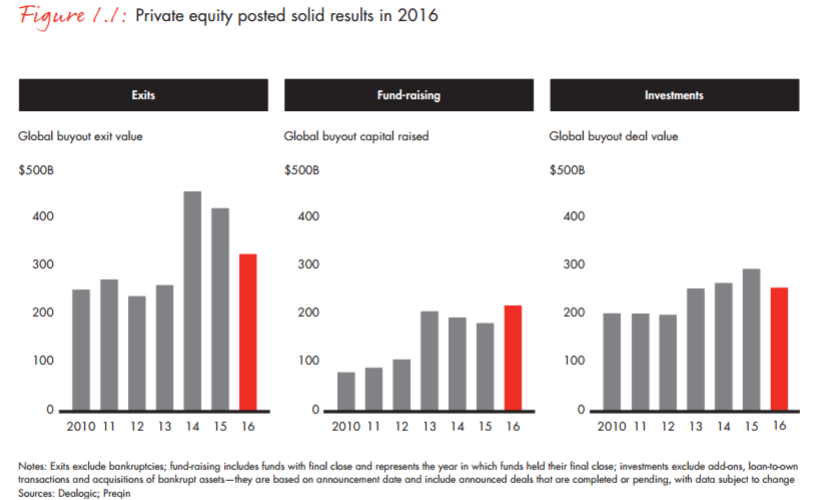

Bain published its 2017 Global Private Equity Report here. For those interested in private equity (who isn’t?), this is a simple and easy read. The PE business continues to do well (fund-raising, exits, returns), with two big caveats: the NAV of funds is going down and assets are getting pricier.

As a simple and graphical way to absorb this report, here are the most telling dozen+ graphics and tables. Bain does such a good job with this.

Exits (PE firms selling their investments) fell from the 2014 and 2015 highs, but times are still good. Investors continue to look for those returns.

Approximately 1,000 exits in 2016. This is down from 2015, with the biggest drop in Europe – no surprise. Bad loans, Brexit, protectionist talk from many European leaders etc. Still better than 17 of the last 20 years.

Snake has digested the elephant. Bain describes the glut of deals which were unable to exit after the financial crisis as an “elephant” which was working its way through the PE “snake”. Graphic visual, I know. Bain notes that only 10% of pre-crisis deals have yet to exit . . .so most of the deals now are POST-CRISIS deals. Indeed, the snake has digested the elephant.

Holding investments for longer. The median holding period is now 5-6 years. Curious if the time frame would be different if it were an weighted average (namely, larger deals take longer time)?

Strategic buyers have the cash, stock valuation, and motivation to buy. Bain notes that organic growth is tough to find in developed markets, and the high stock valuations gives them good currency to buy from the PE firms.

The 10 largest exits to strategic buyers all occurred in the US and Western Europe, led by CVC Capital Partners with the top two deals: the sales of Formula One World Championship in the UK to Liberty Media for $7.9 billion and Spain’s IDCSalud Holding to Fresenius for $6.4 billion. -Bain

IPOs dropped by 40% in volume, and 48% in value in 2016. Looks like the biggest IPO in 2016 was a Chinese company, ZTO Express, backed by Warburg Pincus. d.i.d.n.o.t.k.n.o.w.t.h.i.s.

Follow-on sales are the post-IPO selling down of PE firm holdings. So the PE firm IPOs a company, but holds on to a portion because 1) they believe the stock will continue to appreciate 2) they are in a lock-up period and are required to hold it. Apparently, in 2016, $79B of “exits” came from follow-on sales. . . more than 2.5x the amount they originally IPO.

I-banker readers, feel free to correct me, but that means that for every $1 of IPO exit, the PE firms are selling $2.5 of shares after the IPO. Fascinating.

Dividend recap is a new phraseology for me, but apparently, this is how PE firms take on debt to pay dividends out to the PE investors. This improves liquidity, but makes the underlying asset more risky. Creditors were eager to lend and PE firms are smart to take advantage of that (provided it does not sink the asset itself). Once again, I-bankers, feel free to correct this consultant, but sounds a bit like a leverage buy-out (LBO) too. In 2016, there was $7 billion in dividend recaps.

- Advent was looking for $12B, attracted $20B, settled on $13B

- Thoma Bravo raised $7.6B (hard cap) and was oversubscribed

- Cinven raised $8B (hard cap) in 4 months, 2x oversubscribed

They can’t get enough (private equity). Institutional investors want to put more money to work in private equity, but times are so good (exits and distributions), that they are having difficulty maintaining enough invested. Here is how Bain explained the story of one pension fund:

For example, Washington State Investment Board (WSIB), a well-regarded US pension fund, experienced a steady decline from a 26% actual allocation in mid-2012 to 21% in mid-2016. Over the same period, WSIB’s unfunded PE commitments rose from $8.2 billion to $12.7 billion. – Bain

So they are not invested enough in private equity, even though the money they want to put to work continues to pile up. Sheesh.

High-end PE funds are lowering their hurdle rates. With times so good for PE, in some cases, the general partners (GP) are renegotiating the terms of their funds. CVC has negotiated down the customary 7-8% hurdle rate (the minimum annual return for limited partners before the GP gets paid) to 6%. Advent removed the hurdle rate entirely, and adopted a different payment schema. Not true for middle-performers, but everyone is looking to raise funds while times are good.

Rising prices. Apparently, there are plenty of assets for sale (carve out, public-to-private etc), plenty of debt to help fund the deals, and lots of PE capital ready to invest ($1.4 Trillion with a T). The problem is prices.

More people are hunting for the same assets. This is creating price inflation. Also, let’s remember the business cycle; good times do not always last. There has got to be a recession around the corner somewhere.

PE returns are impressive. If you look at the following two charts, you will see that PE has outperformed broader markets in US, Europe and Asia. Impressive considering Warren Buffet’s recent $1M wager that hedge funds would underperform the S&P over 10 years. PE is doing fine.

No surprise, the top PE funds are killing it. The top quartile of US buyout firms are 20-30% annually. Whoa. That is how you get retired. . .

So many flavors of PE. For ignorant people like me, this is an entirely new world. Great run-down of the different types of PE funds and strategies. See page 45. Here are a few mentioned and described:

- Contrarian

- Playbook value

- Macro-trend

- Cross-pollination

The second half of this report also talks about specific industries, geographies and strategies. For those who really want to geek out, this is great.

Understanding the PE process. Perhaps the most fascinating part of this report is the “process” of becoming an effective PE investor. How to cultivate and manage a network of people who can give you specialized insight into a deal. For consultants, lawyers, bankers, and other professionals, read the report starting on page 48. Great insider scoop on how to win at PE.

Build a network starting now. Take a look at this table which breaks down how and where you will likely spend your time developing a network. Great advice, I think. (click on table to enlarge)

Web-scraping: This is fairly off-topic from the macro-view of where the PE business is headed, but instead talks about the different way up-and-coming, scrappy PE associates can add value by digging up information from the internet. See the following table as a “how to” to get industry insight and competitive intelligence legally from the web. Page 58 in the report. (click on table to enlarge)

What is the vision? Where to play? How to win? These three questions makes my heart sing. Bain breaks down in such simple terms – the key questions that executives need to answer. You have to make choices and set up the activities which self-reinforce your strategy and make it hard to imitate.

Only a consultant could make the table below, and yet, it’s pretty good. Take a look, also on page 63 of their report. Figure out how you are adding value and then do it. (click on table to enlarge)

Here is the report. It is worth your time:

Bain & Company: Global Private Equity Report 2017

Related posts: