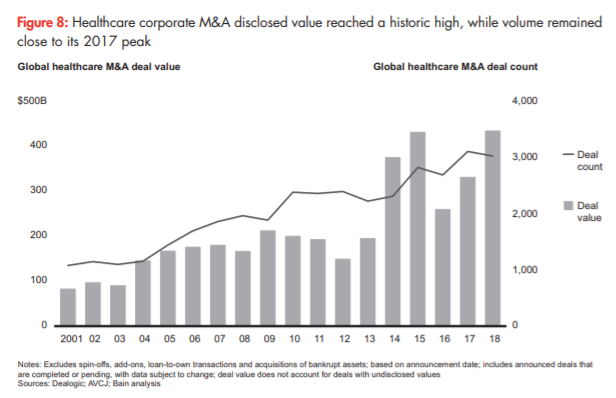

Healthcare M&A = $435 Billion in 2018

As a headliner, 2018 was a blockbuster year for Healthcare M&A at $435B. This graph is UP and to the RIGHT. There were 2 big deals that made up 1/3 of the total deal value: Takeda bought Shire Pharmaceuticals for $80B here, and Cigna bought Express Scripts for $67B.

Bain & Company argues there were 3 main investment theses, all centered around revenue growth:

- Category leadership – doubling down on core competencies, and divesting from distractions

- R&D-centered acquisitions – looking to replenish R&D and product pipelines

- Vertical integration – capturing more of the value and reducing transactions costs

Category leadership = more core competencies, and corporate clarity

- Bain notes that Pfizer and GlaxoSmithKline carved out their consumer healthcare division into a new joint venture with $12B in sales. Investor relations pack here (1.1Mb, 25pgs).

- Johnson and Johnson divested of two of its “non-core” assets: Lifescan to Platinum Equity and Advanced Sterilization Products to Fortive. Other companies divesting include Shire, General Electric, and Novartis. JP Morgan notes this “corporate clarity” is happening across sectors here.

R&D centered acquisitions

- Sanofi buys Bioverativ for $11.6B. As Sanofi explains, hemophilia is a $10B market, growing at 7% here.

- Celegene buys remainder of Juno Therapeutics for $9B. This included 100 scientists, “best in class” CAR T therapies with 8+ targets and 10+ indications, and a “novel and scalable” CAR T manufacturing platform here.

Vertical integration by health insurers

- Cigna and PBM Express Scripts completed a $67B merger here. Now the 3 big pharmacy benefits managers (PBM) are tied up with insurers. This may be one of the few market-driven ways to reduce complexity in the US healthcare payments system. Taking out the middleman.

What’s an investment thesis?

The Bain report is about Healthcare deals, but there is a gem of a table that is show below. This is the structured thinking that helps consultants drive clarity, prioritization, and action. From left to right:

- What’s the business, products/services, and how do they make money? (Great first question)

- How big is the market, the reason business could pick up? (potential for more horizontal integration, bolt-on-acquisitions, economies of scale)

- What’s the competition, and positioning look like? (what’s the chances of winning this fight?)

- How well has this place been run, as evidenced by the financials? What are the risks to the forecast?

- Where else can we add value? (read: EBITDA)

This reminds me of something from a HBR Ideacast interview here with a founder, who said that VC ask 3 questions:

- Why you? Why are you the right team to go after this large opportunity?

- Why now? What has changed in the market, so it is the right

- How will you build a category-defining company worth billions of dollars?

What’s an integration thesis?

Yes, there is a second gem about integration too. Going from Top to bottom, left to right:

- Once you have an investment thesis, and a vision for the new company

- What’s the ambition for the merger? Keep them separate (read: BRK-B approach) or transfer skills and share activities?

- What will get integrated? by how much? in which sequence? Why whom and how?

Sponsor-to-sponsor exits: 47% of the total volume

While initial public offerings (IPOs) capture the news, the majority of exits are to other financial sponsors (red bars). A few reasons might include: 1) private equity has lots of “dry powder” to put to work 2) PE firms are bolting-on to existing platforms to create greater economies of scale 3) timing for public markets might not be perfect.

Holding periods are shrinking, really?

The average holding period for PE-backed healthcare assets is only 4.1 years. That’s an amazingly short amount of time to 1) get the money 2) select an investment 3) improve EBITDA 4) sell it to someone else.

Looking ahead, funds may decide to opportunistically exit deals and take advantage of heavy sponsor demand for relatively recession-resistant assets and high valuations. On the other hand, funds may decide to lengthen their holding period if they possess a category-leading asset and don’t have pressure to sell. In some cases, a longer-term value-creation plan to raise incremental returns may be more valuable than selling top-performing assets and hunting for ways to redeploy large sums of new capital. – Bain & Company

What this means for healthcare investments in 2019

- Yes, there will be volatility expected with interest rate increases and continued nationalistic political rhetoric

- However, healthcare investments are considered less cyclical, almost immune, to the economic cycle

- PE firms have lots of “dry powder” and fund-raising continues to go well (more money coming in)

- Expect more collaboration (among financial sponsors and with strategic buyers) to take down larger targets

- Buyer are willing-to-pay higher multiples for high-quality assets and platform companies with pricing power

- If the stock markets dip, this may create buying opportunities for PE firms

“Make your own weather”

A friend of mine said this over lunch one day. The easy, obvious trades have all be picked over. To get alpha – nowadays – you need to be more creative with the financing, integration, and operational improvement. It takes more effort than in the past to “beat the market.”

Wherever they compete along this spectrum, investors will not only have to execute an airtight acquisition and integration playbook but will also need to flex new muscles and develop more creative approaches to building scale or category-leading assets. – Bain & Company

Related posts