Bain & Co published their Global 2020 Private Equity Report here in February 2020. Like all things Bain, it is very readable and useful. Here’s my tear down of the first 30 pages of the report:

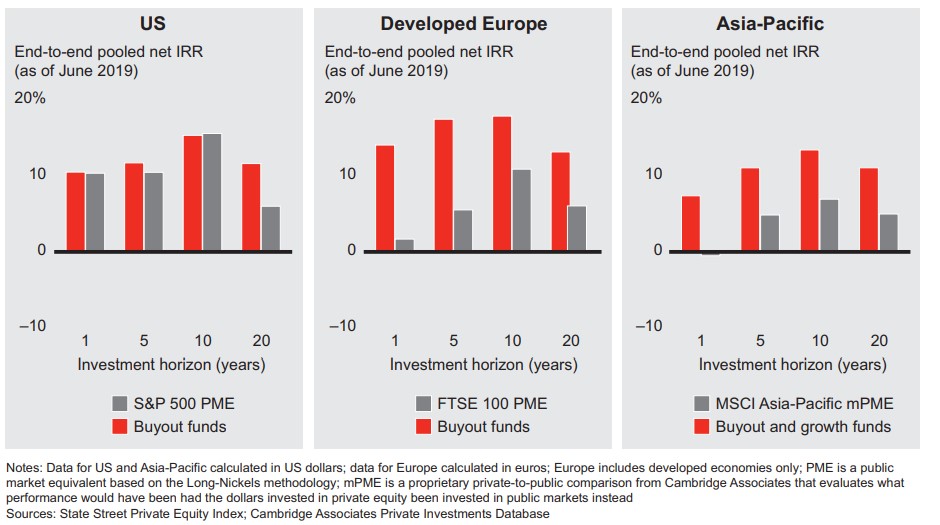

Buyout firms have outperformed

Starting with the main point, PE firms outperformed public equities across regions, and most time frames. Basically, they find good value, do the work, find ready buyers, and give their investors returns. You will note – however, that the spread is shrinking in the US. . over 10 years, the red (PE) and grey (US stocks) are neck-and-neck. In Europe and Asia, no comparison – red wins.

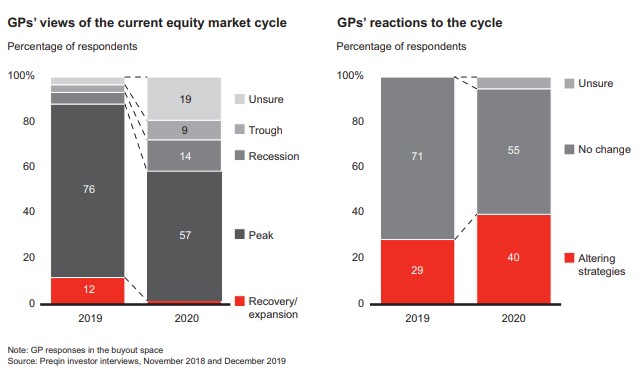

Fund GPs are bracing for a downturn (Preqin)

This caution was true in 2019, and more so in 2020. Even for a layman like myself, this makes sense. Valuations remain high. The economy is definitely not on a recovery path, in fact, it’s getting by largely on the sugar-high of cheap money from the central banks.

This does not mean that private equity is sitting idle. Of course not – even at low rates, there is opportunity cost of time. LP want their money back in 5 years + returns. Still lots of of work, thinking, and positioning left to do – it’s just a change in tenor and direction.

More focus on counter cyclical positions. More caution during due diligence. As Will Rogers quipped many years ago about making money, you need to “buy low” in order to sell high.

Roughly 40% of PE funds have altered their investment strategies, with some assessing recession risks more carefully during due diligence.

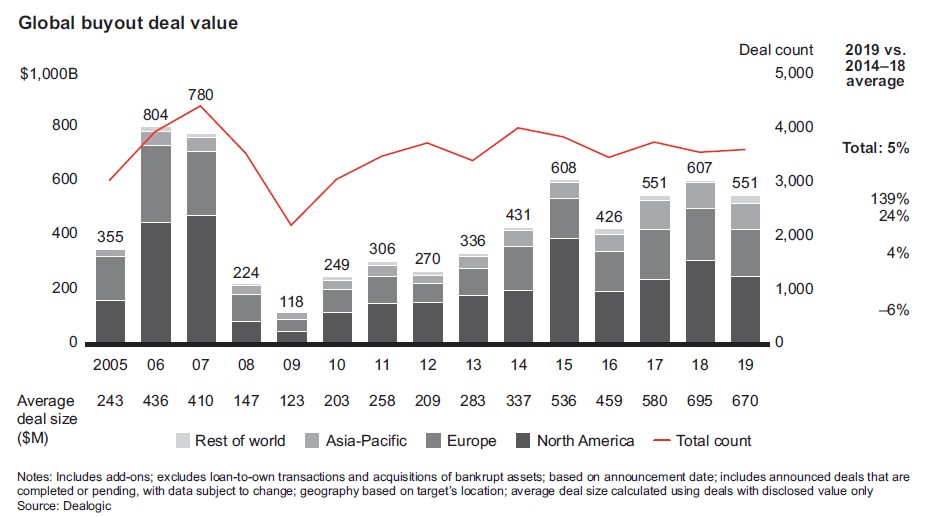

2019 Global Buyout value at $551B

The graph below is an eyeful, so here are some observations:

- Number of deals (red line) is pretty flat at approximately 3,600 / year

- Deal value is also fairly flat at $551 Billion

- Last five years have been strong for PE ($608B, $426B, $551B, $607B, $551B)

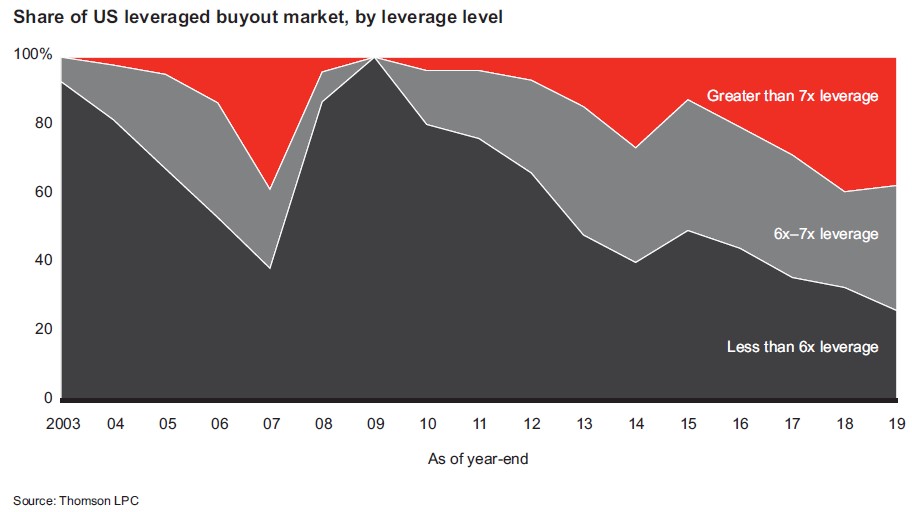

Leverage continues to increase; covenant lite loans

Money is so cheap (10 year treasury at 0.58% this morning) that if you can get a good return, of course it makes sense to borrow (mo) money. Check this out. . deals with greater than 6x leverage is 75% of all deals (red + grey). Bain attributes some of this to the increase in “covenant lite” loans here. Covenant is not a term I use/hear often – in fact, the closest thing it makes me think of are HOA convenants in my neighborhood. . .rules, guidelines etc. . . Bain Capital notes that they “comprise nearly 80% of outstanding loans and have become standard within the US institutional loan market.” Easier to get loans and LOOSER loans.

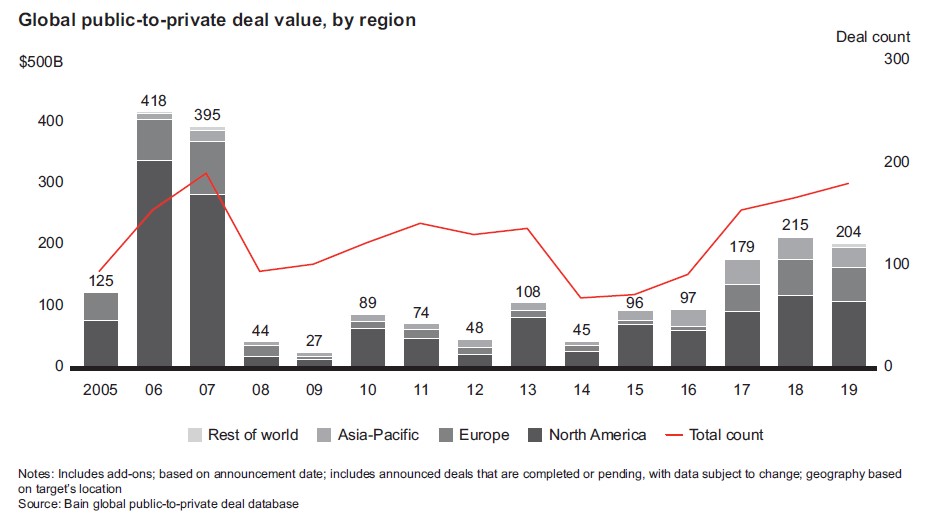

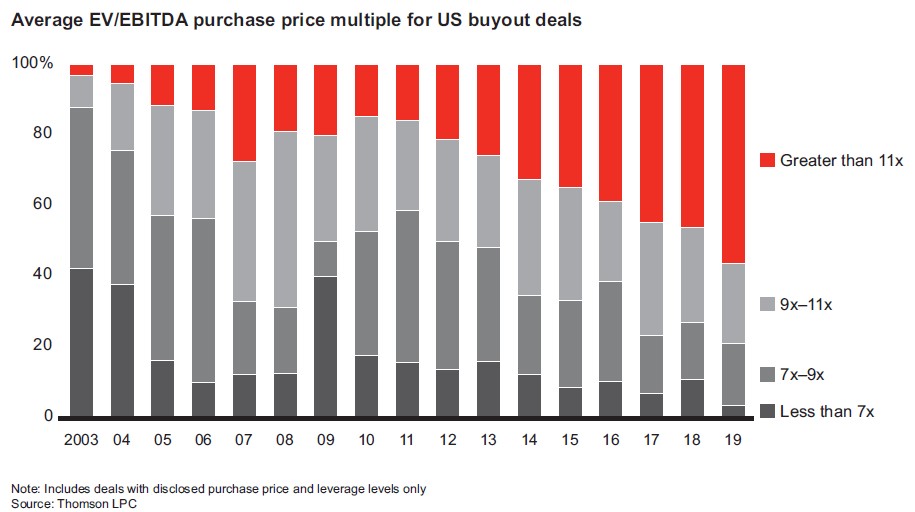

Things are not cheap; more public-to-private deals

The massive increase in money supply + slow growth environment has lead to “aggressive corporate buyers” and increasing purchase price multiples. In the graph below, 55% of US buyout deals had EV/EBITDA purchase multiples of more than 11x. Not cheap.

As a result, PE firms are “broadening their hunting grounds” looking at (larger) public companies. Eight of the top 10 deals were public-to-private deals, almost reaching the peak from 2007. Who would blame the public companies wanting to go private. Public = greater regulatory reporting requirements and quarter-to-quarter shareholder expectations.

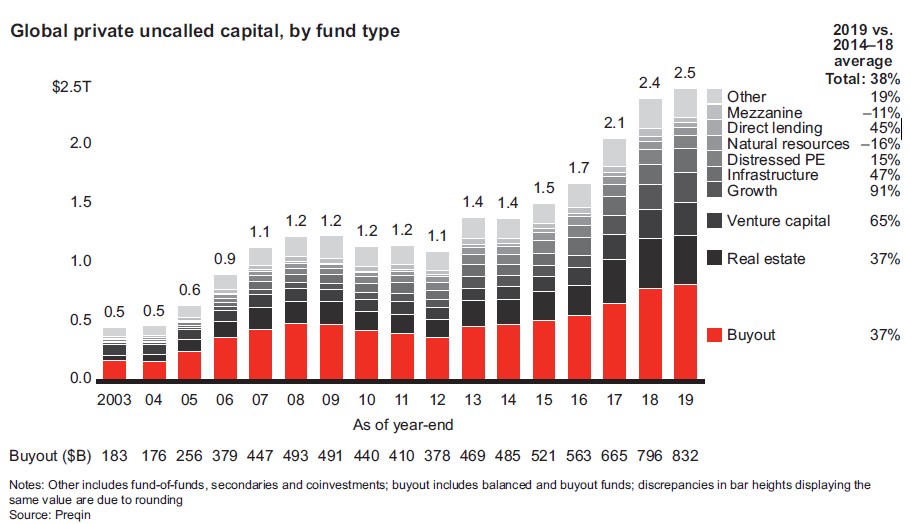

Lots of “dry powder” ready for investment: $2.5 Trillion

There is $2.5 Trillion of “dry powder” across all fund types – looking to be deployed, looking for a home. As you can see the in bar chart, the “uncalled capital” is stacking up for a few reasons: 1) private equity has remarkably beat most other asset classes for the last 10+ years 2) money is cheap 3) stocks look expensive. Thankfully, the vintage (the year the $$ was raised) is actually quite young at 2.6 years. This means that the firms have a longer potential lead time to put the money to work, get a return, then return to investors within an acceptable (if slightly longer than 5 year) window. You don’t want a fund with a lot of your money undeployed at year 4, right?

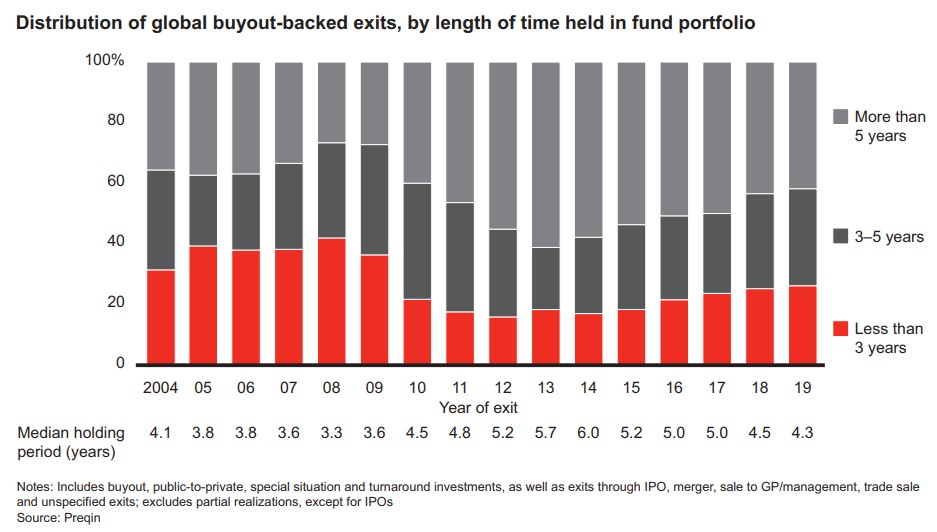

Holding periods are falling (again)

It’s always surprised and impressed me that PE firms try to return capital to their investors within 5 years. Sheesh – sometimes it takes me 5 year to finish a book, or finally finish a series on Netflix. If you see the graph below, the median holding period across all exits fell to 4.6 years in 2019; investors are getting their money back more quickly. Not like the days of 2012, 2013 when the money was tied up in investments which got hurts in the 2009 financial crisis.

Create value (not just “find” it)

I remember having lunch with a MBA friend a few years ago (hat tip: CC), who said something about the investment climate, “You have to make your own weather.” In short, the easy and obvious price arbitrage has long gone. Instead, you need to think through new/creative ways to create EBITDA and value for buyers. Some of the big themes and exit types:

- Good to Great: stable companies that could improve their operations

- Improvement potential: public companies doing “okay” but need a new cost structure

- Turnaround of distressed asset: self explanatory

- Portfolio breakup: carve-outs from conglomerates looking to refocus on their core

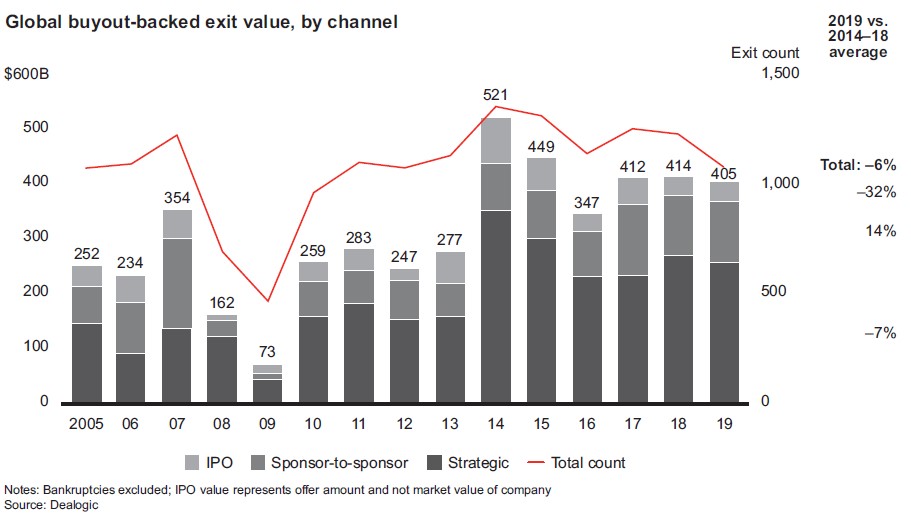

- Sponsor-to-sponsor exits: sales to other PE firms “sponsor”s is 30% of total

- Dividend recapitalizations: PE firm takes on new debt and cashes out original investors

- Initial public offerings: clean exit for PE firms to the private market, small portion of total

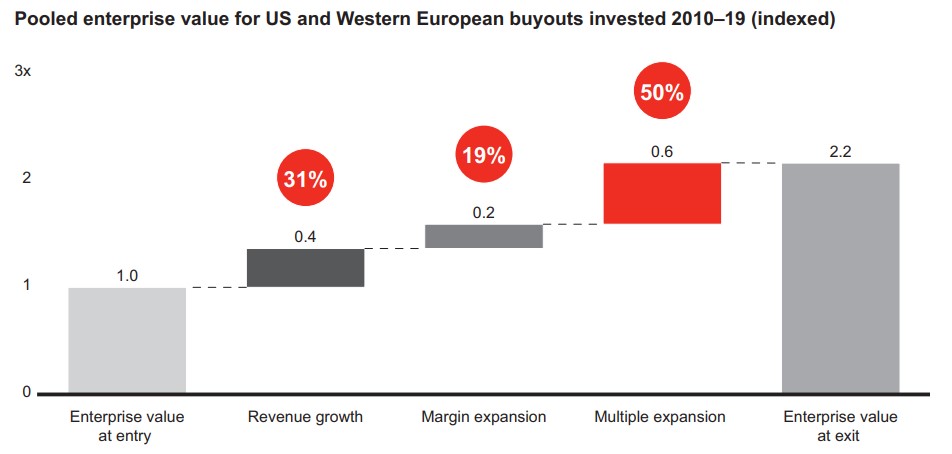

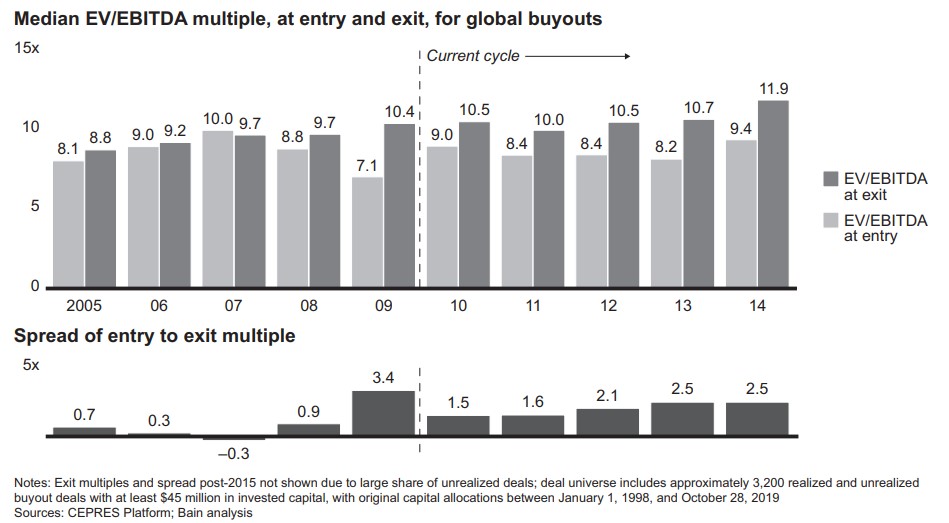

For the last 10 years, multiples have expanded

Perhaps this is an obvious point, but all this cheap money creates inflation. More money chasing the same assets and returns. Also, as PE becomes a bigger asset class (read: $551B in deal value), there’s only so much revenue & cost synergy (the entire category) can create. So what can lift all boats? The entire ocean. Multiples.

Our analysis of CEPRES data for about 430 fully realized buyout deals completed between 2010 and 2019 in the US and Western Europe finds that growth in multiples led to nearly half of the increase in enterprise value. With multiples at record highs and macroeconomic conditions deteriorating, the spread between entry and exit multiples has likely plateaued and could start to diminish.

Going forward, smaller spread of entry vs. exit multiples

This is perhaps the deepest point of Bain’s analysis. PE firms will need to find new ways to create returns because the spread between entry and exit multiples will likely flatten. In fact, they note that “most GPs no longer include multiple expansion in their deal models.”

Needed: New levers of value creation

Time for PE firms to “make their own weather”. M&A to bolt-on acquisitions to a platform, get more market share, create new products, scale internationally. Get after it.

Read the full report here. This tear-down only discussed the first 30 pages.