Private equity (PE) has outperformed

By most measures, private equity has given investors better returns that most asset classes over the last 5, 10, and 20 year time frames. It’s been an incredible run. The names of Blackstone, KKR, and Apollo have been become almost common as Fidelity, Vanguard, and T. Rowe Price. So how is PE looking now?

The PE deal environment is weakening

This is not a controversial statement and is to be expected. First, 2021 was a record-breaking year, so that will be hard to top. In addition, inflation is up, interest rates are up, supply chain woes continue, Covid-19 variants persist, there is war in Europe, and the public stock markets are down 20-30% in the US.

Pitchbook does great work

If you have not read through any Pitchbook’s content, take a look here. You need to load in your name, email, phone, but it’s worth the effort. They have content on private equity, M&A, and venture capital.

US private equity trends (as of 1H 2022)

Read through a 35 pg report called US PE Breakdown. You can download it for free here. Well written, crisp and full of details. Bain & Company takes a lot of this information and created a 84 pg free report here. Both reports are worth your time, depending on your interests (geographies, industries, and trends).

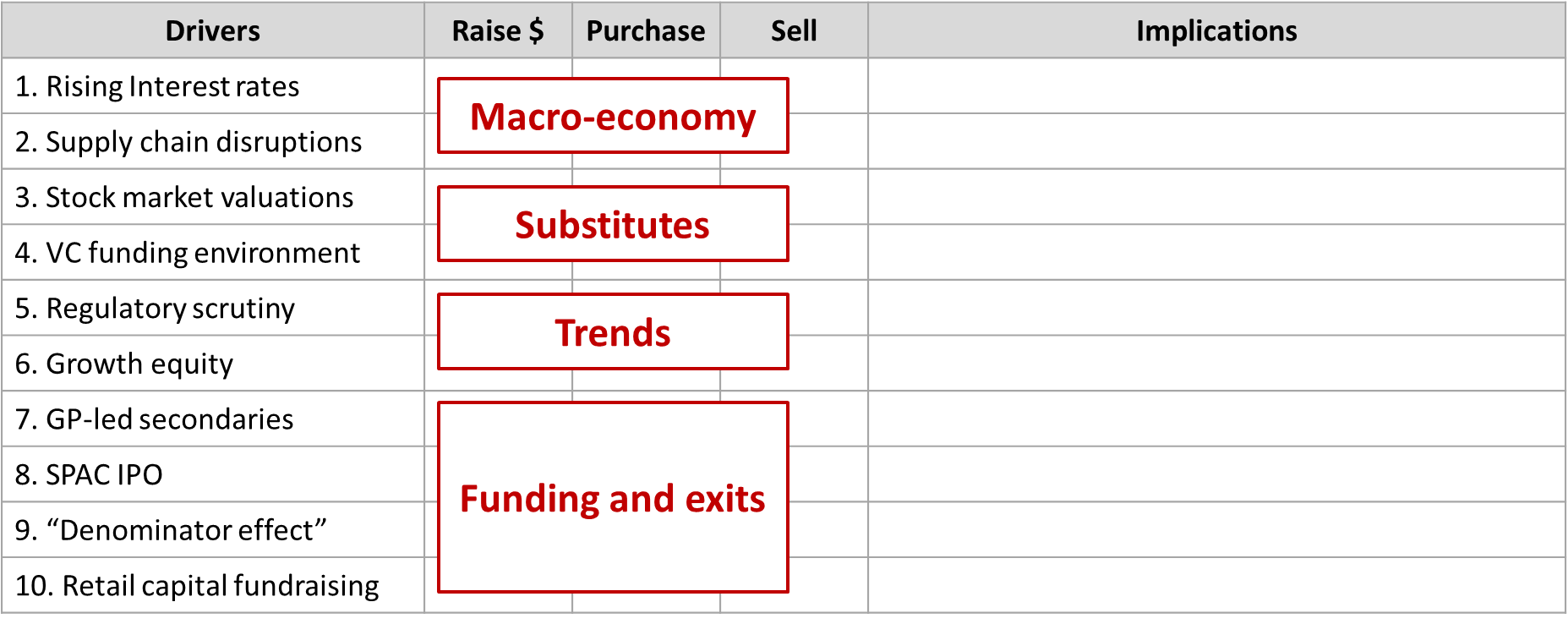

Make 1 Page a Day

This is often the advice I give consultants. Practice distilling an analyst report, or new article into 1 page. The slide I made today is more of a table, than a page full of words.

Put the information in a table

A good friend of mine (hat tip: BMS) laments that people don’t use tables enough. Agree 100%. It’s a clean and organized way to show information. Here’s an example that I put together for you.

On the left-side, the rows show the 10+ different drivers affecting PE. (Of course, there is more than this, but this is a framework, a simplification, a way to understand something).

The top, the columns, show 3 big steps in a private equity fund. Raising the money, purchasing a target company, and selling it for a higher price. I added some implications on the right.

No surprise, the topic is complex

One thing you learn in MBA is that everything is more complex and nuanced that you might think. To say that “private equity” is XYZ, is probably wrong. It’s multiple things at the same time.

- There are macroeconomic factors (think: inflation, interest rates, supply shocks, Covid-19 displacement)

- There are impacts from publicly-traded stock valuations and VC fundraising

- There are trends in energy, technology, industrials, regulatory scrutiny

- There are different trends in funding (retail, secondardies) and in exists (IPO, SPAC, sponsor-to-sponsor)

Namely, “it depends.”

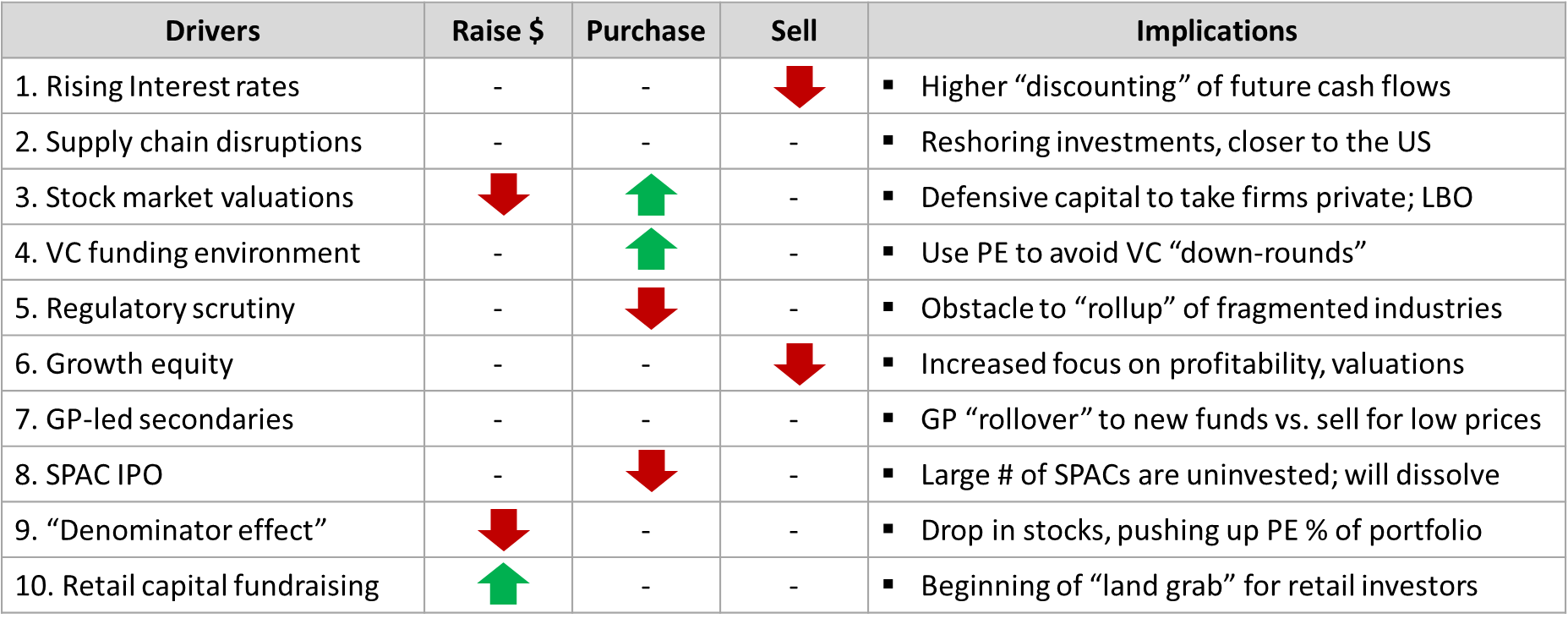

How to visualize this data?

While there are numerous “facts” in the report, I wanted to summarize the high-level factors in one page. This is harder than it sounds because you need to arbitrate what is “this important” and what is not. Yes, it’s subjective, but that’s also where some of the discernment, wisdom, “ah-ha” value comes from.

I opted for some simple up & down arrows. You will notice that I did not add a definitely statement in each of the 30 cells. Instead, you will see that there are 6 down arrows, and 3 up arrows.

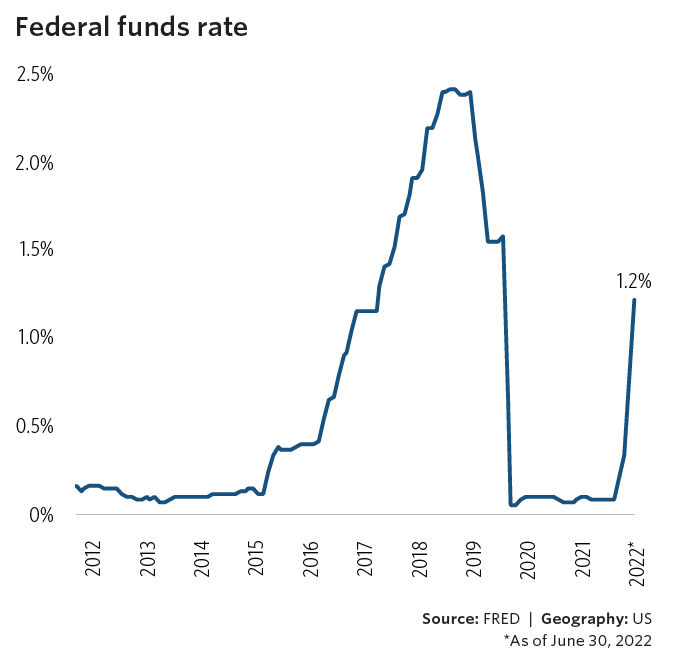

1. Rising interest rates

In the Pitchbook report of 15,000+ words, “rising interest rates” was mentioned within the first 20 words. This is not a surprise as private equity uses leverage (debt) to amplify the EBITDA returns of a business. Rising rates = higher opportunity costs of the money, higher carrying costs, higher hurdle rate.

You don’t have to be a LBO specialist (I am not) to understand that private equity benefits from lower borrowing costs, and if you want this to be as low as possible, then this graph isn’t pretty.

2. Supply chain disruptions

While some of this has smoothed out, everyone in the US has felt the slowing down and jerkiness of the global supply chain. As you can see below, the DBI (Dry Baltic Index) is still high compared to it’s historical average.

The days of “oh don’t worry, there’s lots of supply” are gone. As a result, procurement departments around the world and re-thinking their supplier strategy and the necessity of reshoring some of their supplier base. Business continuity planning is once again, in vogue. It’s a VUCA world (volatile, uncertain, complex, ambiguous).

3. Stock market valuations

Don’t even get me started. The S&P is down 20%, and the Nasdaq is down 30%. As I told my students at the end of the spring semester, “Don’t ask your parents for money, their 401(k) is down. Don’t put them in a bad mood.” See the YTD performance by sector here.

In contrast, this might provide opportunities for PE firms. We should all expect to see more companies “taken private” because they have lower valuations, or need an infusion of capital.

4. VC funding environment is “fragile”

The same factors affecting private equity (interest rates, recession fears, falling stock prices) is also souring the mood for venture capital. As a substitute for VC, this can also serve as an opportunity. Less VC, more PE?

5. More regulatory scrutiny

Pitchbook argues that we will see more government involvement in private equity because it’s no longer a niche investment class. With AUM (assets under management) of $2 trillion, this is the big leagues.

This could influence the PE strategy of “rolling up” fragmented markets to drive economies of scale, pricing power, and network effects. We can argue what a “dangerous level of market concentration” (e.g., high market share that leads to oligopolistic or monopolistic pricing), but it’s not controversial to think that regulators will get more picky, nosey, demanding, and aggressive. Economist has a cover story on Jan 15 called “The bossy state.”

6. Growth equity

Rather that John trying to explain this, here’s what Bain & Company said in their report (pg 8) here:

“The message for GPs is clear: While the private equity industry has been extraordinarily busy over the past year, it’s not just about buyout anymore. Increasingly, investors are tracking down growth and diversification wherever they can find it across the broad private equity spectrum. ” (Bain Private Equity 2022 Report)

Now, the challenge.

Higher interest rates affects both a) the prospects of growth (in a slowing economy) and b) the value of those future cash flows when discounted back with a higher hurdle rate. This is why some fast-growing technology stocks have been crushed over the last 6 months here. The anti-growth case sounds like this: Company XYZ will make more money in the future. . . .but, the opportunity cost of money is higher, so that future money is not as value as I used to think it was going to be. Growth for growth’s sake? Less attractive idea now.

7. GP-led secondary transactions

This was new for me, but makes sense. Roll-it-over. PE fund #1 buys a target and plans to sell this within 5 years and return $$ to the LP. However, this takes longer than expected or the market drops. GP doesn’t want to sell at an unnecessarily discounted price. Logical. So what do they do? Bain & Company quote below in blue.

By creating a market for preexisting investor commitments, secondaries provide liquidity that solves the problem on both sides; it gives LPs a way out when they need it and allows GPs to stay involved with a promising asset as long as they see fit. (Bain Private Equity 2022 Report)

This makes sense on so many levels:

- PE has been crushing the returns, they have an enviable track record

- Institutions often have long time-horizons (e.g., doesn’t matter if it’s 5 year or 7 year or 12 years)

- Fundraising continues unabated; people want PE returns. Some LPS may want out, but others want in

8. Oh, SPAC

Not sure what else needs to be said. SPAC were hot, now they are not. As a common-sense sidebar, why would you invest in a special-purpose-anything when you don’t what it is. That’s like you enrolling in a MBA course called, “Trust me, I will tell you later.” The Economist notes that many SPAC have not found investments:

Of the 298 spacs listed in the go-go first quarter of 2021, raising $97bn, 196 have yet to announce a de-spacing. In all, more than 600 American-listed spacs are still searching for a target. (Economist, 05/22)

9. “Denominator effect” = Too much PE

This is an interesting one. Logic goes like this:

- Some large institutions have by-laws that stipulate how much $$ can be in different asset classes

- Since stocks have fallen so much, the PE equity portion (as a % of total) may have reached its max

- Even if the PE have not been marked down (yet), the denominator has shrunk

- So the PE portion may be “over-weight” vs. what the insurance companies, endowments, pensions want

- Some reallocation (read: selling of PE portion) may be necessary

Two countervailing thoughts:

- if stocks go up, the denominator goes up, problem solves itself

- if PE firms “mark down” the value of their holdings (not pretty), this could also solve the problem

10. Retail investor fundraising

As I started this blog post, PE has historically outperformed other investments. However, it’s always been the realm of sophisticated, deep-pocketed investors. Now that is changing.

Blackstone in particular has been scooping up $4 billion to $5 billion in equity capital from retail capital per month. The firm’s nontraded REIT, known as BRIET, has more than doubled in size over the past 12-months to $68 billion NAV. (Pitchbook, US private equity breakdown, 2022)

Covid-19?

As I finish up this blog post, I am struck by the fact that Covid-19 is not in my list of top 10 drivers influencing PE deal environment. So many potential implications:

- It’s become a fact in the business environment; we are working around that

- It’s the “first domino” so the other 10 factors are follow-on secondary and tertiary effects

- It’s too broad of a topic and means too many things across different industries, environments

One pagers, Tables help to have a discussion

This table is not definitive. For those who work with private equity daily, feel free to add in comments on other factors (rows) to include. Also, you might disagree with the placement of the up & down arrows. That is fine.

This is meant to be a one-pager that helps us to have a discussion. So, let’s have a discussion.